Whether you're new to real estate or a seasoned expert, it can never hurt to consult a homebuying guide. While talking to real estate agents is a great starting point, there are other factors and tasks to consider that complement their support.

Here are some of the things to think about as you prepare for your homebuying journey:

Factors to consider before your home search

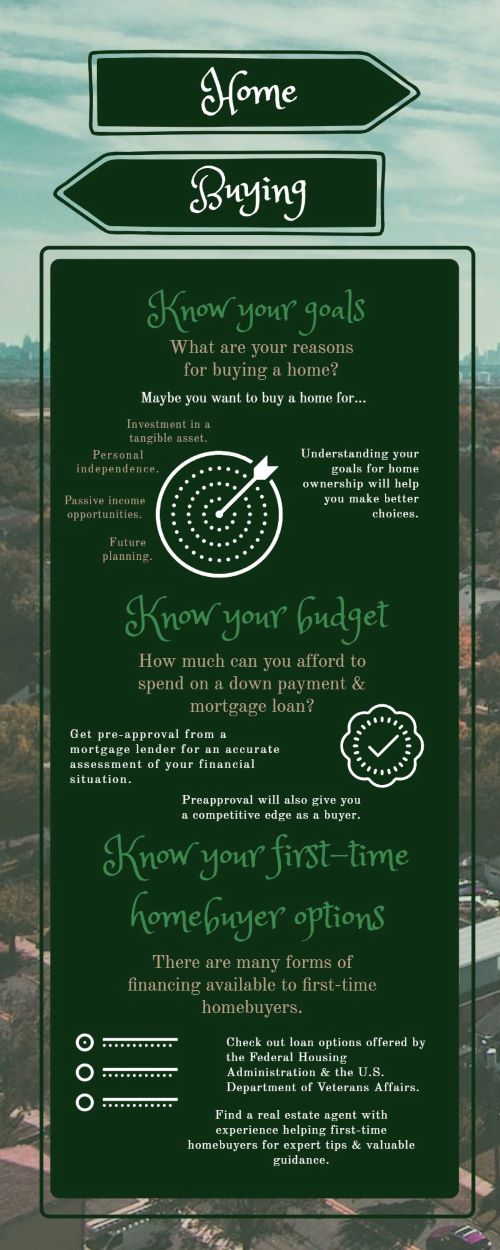

What should your goal be before you get started? Think of all the homeownership options. What are your reasons for buying a home? Maybe you want to buy a home for investment, personal independence, passive income opportunities or planning for your future.

These are just some reasons potential buyers think about buying a home. Understanding your goals for homeownership will help you make better choices.

The homebuying process

The basic steps in buying a home typically are:

- Search for listings meeting your specific criteria and budget.

- Make an offer on a home.

- Negotiate purchase price if necessary.

- Get a home inspection & appraisal.

- Close on the home (pay all closing costs & complete all necessary paperwork).

Special conditions for first-time homebuyers

There are many forms of financing available to first-time homebuyers, such as those offered by the Federal Housing Administration and the U.S. Department of Veterans Affairs. You may also want to find a real estate agent with deep understanding and experience in helping first-time homebuyers for expert tips and valuable guidance.

How much money should I save before buying a house?

What is your maximum budget for the down payment and mortgage loan? Pre-approval from a mortgage lender is needed for an accurate assessment of your financial situation and gives you a competitive edge as a buyer.

Are you ready to get started on your journey to homeownership? Keep these basics in mind as guidelines for making the best decision and finding your dream home.

About the Author